There is some debate as to whether a debit card for teens is appropriate. It seems like the concept divides opinion somewhat. In this blog post I take a look at the advantages and disadvantages of plastic money and whether or not it’s suitable for a teenager to have a debit card. I also take a look at the alternatives.

2015 saw the launch of Apple Pay. Love Apple products or hate Apple products. The love hate relationship that people seem to have with this company, is not massively relevant to this blog post.

The only reason I mention it, is that when the worlds most profitable technology company does something, as someone who works in technology and blogs about technology, I tend to sit up and take notice.

[+] More Info

[-] Less Info

If you don’t know what Apple Pay is, then allow me to take a few moments to explain. Apply Pay allows you to link your credit to debit card to your phone. Then wirelessly, or contactless to use the proper term, I can pay for goods and services using my phone and my fingerprint.

This is a massive step in the technology world. The smartphone has already took the place of the music player for most people. The late Steve Jobs, one of the founders of Apple cited in his autobiography, that one of the main reasons for the iPhone, was that the mobile phone could kill the iPod.

At the time, the iPod (Apple’s digital music player) was their number one seller. At the time it was generating the company most of its profits. I suppose to be innovative in business, you not only have to know what will grow your company, but potentially what can destroy your company.

Most consumers have replaced the iPod with the iPhone for playing music. Looking around most public places, the smartphone is the number one way people interact with one another.

Also over 60% of Google searches now come from mobile devices. So it seems that the mobile platform has replaced the PC for how people consume content on the internet.

The Phone to replace cash?

So if we have replaced how we play music with a smartphone, how we consume internet content, how we email and interact with one another. It seems like the smartphone is more and more at the centre of our lives.

Apple Pay demonstrates and the last decade teaches us, that the smartphone has it’s eye on replacing cash.

We are a long way off yet though! Currently Apple Pay has a £30 limit but as I explained in my previous blog post, lots of smaller transactions can add up to a large amount, leaving you in financial hardship.

The retailer we are wanting to pay, must also have a contactless credit card machine, to accept Apple Pay. This is possibly another reason why it may take a long time for this concept to become more main stream.

So cash is here to stay, certainly for now. Let’s be honest, it will probably always be with us.

The problem our teens face

I had a relatively happy childhood. My teenage years were overall enjoyable. However, I am not sure I would want to be a teenager in a modern, always connected, always in contact world.

My oldest child has been asking for a smartphone since he was 8, so far I have managed to resist. Mainly on the grounds that he doesn’t have any practical use for a smartphone.

However, high school beckons next year and so the pressure to have something that “everyone else has”. Will no doubt begin.

A phone also has the benefit that as a parent, I can keep in contact with my child. Especially as they enter a stage in their life where they want to explore more than the back garden or the street that we live on.

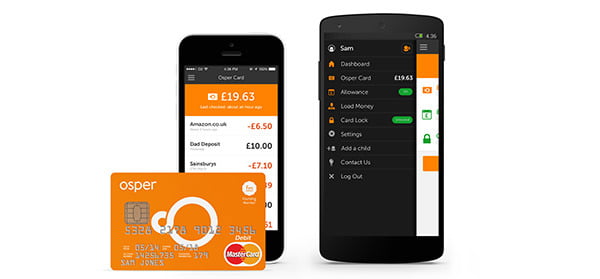

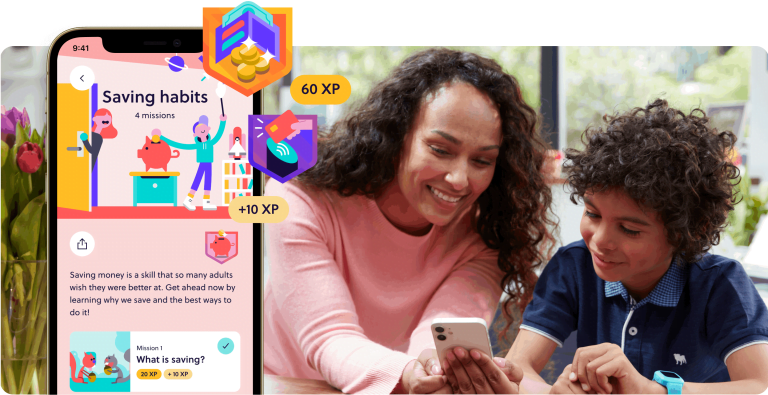

So given a world where a child can have a smartphone and pocket money from such a young age. We are seeing an emergence of companies like Go Henry and Osper, combine the two.

I get that for some parents, this is taking it too far. For many parents who’s children are aged between 8-18, (Go Henry and Osper’s target market), they were victims of a crash in the economy caused by debt. Why on earth would we subject our children to such an horrendous thing!

My point is that whilst an economic cash does leave a sour taste in your mouth. Especially if you lost your job or home because of it. If lessons are to be learnt, they need to be learnt from a younger age.

Despite the crash, you can still obtain a credit card at the age of 18. Without any proof of income! As a parent, I have took the decision to try and help my children, that when they get to 18, to understand the dangers of uncontrolled spending. That when they are legally responsible and I cannot prevent them, they have learned enough self control to not spend more than they earn.

My preteen has a credit card!

No quite the truth or that shocking. He does’t have a credit card, he has a prepaid debit card, that is linked to a smartphone app, that I control. He also has the ability to withdraw cash and be old fashioned.