Rooster Money, formally known as Rooster Bank, is a useful piggy bank website allowing children to learn the values of saving pocket money, gifts and allowances towards goals and targets.

Parents can set up roostermoney.com accounts for their kids and teaches children the benefits of wise money management and the importance of setting up regular savings plans to achieve targets.

Each of the pocket money apps that we have reviewed on this website all have their own unique angle and RoosterMoney differs from Go Henry, Osper and Pockit. In this RoosterMoney review, we look at the differences.

The Rooster Money Dashboard is easy and interactive, allowing children to quickly learn how to allocate their savings to goals so they can buy the items and products they really want with their own saved money.

You can access most facilities on the Rooster Bank Dashboard, however, your child will have all the responsibilities for allocating money to all the goals and savings plans that are set up on the system.

The Details

The RoosterBank service was set up in the UK in the year 2012 and designed by parents and children to provide a great savings and money management too, with a variety of useful options.

Kids cannot set up their own account with Rooster Bank, it’s up to parents to sign up for the service. However, once the account is active, the child can be added.

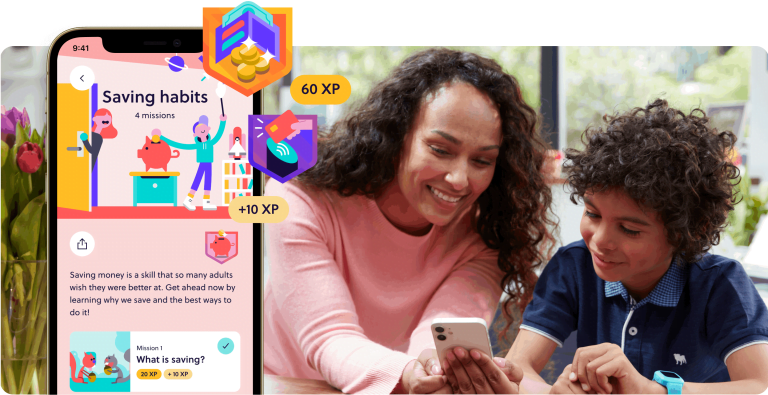

You can add more than one child to an active account and each child has access to a dedicated Rooster Money dashboard, with a host of features. Rooster Money gives kids ideas and advice on what to do with their savings and a variety of interactive games options and challenges are also targeted towards waking up their financial instincts.

Rooster Money is only available to children and families resident in the United Kingdom and the site provides secure access for members. From Spring 2016, the site is allowing access for other family members, so it will be possible for you to add grandparents and another parent to the site.

This way adding “Boosts” to increase your child’s savings will become much more simple and allow your child to reach savings goals more quickly.

There are several reasons to add Boosts to your child’s savings, these are listed in the Boost Edit Reasons screen option. Setting up pocket money allowances and changing the allocated amount of money is easy to amend via the Settings page of your Rooster Bank Dashboard.

Strapped for cash parents are sure to appreciate the fact that Rooster Money savings are virtual money, therefore, it’s not necessary to make physical cash deposits into bank or savings accounts for your child.

As the virtual piggy bank monies are accumulated, your child gets to see just how much cash is being held for him/her. If you are and about and your child wishes to spend some of his/her savings, it’s simple to change the virtual totals in the Rooster Money account by using “Remove” to create a one off debit from the running total.

Goals and The Safe

The Goals option on Rooster Bank is a way to create savings goals. Parents or kids can set up goals and kids allocate a portion of savings towards them. Children are allowed a maximum of six goals at any time and this valuable option really does teach kids the value of money and how savings accumulate into larger sums over a matter of time.

Parents can edit and delete goals from the interactive Dashboard, however, it’s important for the child to allocate the relevant sums of money. Once target goals have been achieved, it’s just a case of arranging to buy the item for which your child has saved monies. Rooster Bank may offer purchase options at some point in future, however, this is not a capability on the site at this moment.

The Safe is another way for your child to allocate savings, this is a default account which can be combined with real savings accounts to give cash savings that earn interest.

You can easily edit The Safe and adjust the savings total. Only your child can add money to the balance, but you can take the balance back to zero when you transfer cash to their savings account.

Of course, parents with password access to their child’s Rooster Bank Dashboard can easily add money to The Safe, but it takes away some responsibilities that you should give to your children.

Bank Statements

Just like any normal bank account, the Rooster Bank service provides regular statements giving details of all piggybank savings. The statements are concise and list sources of money, so it’s easy to check on who has credited cash to your child and the relevant dates.

The simple Statement layout allows your child to pick up financial management in full, giving details of all debits and credits and sums allocated to the different Goals on the account.

Setting up Rooster Money

Setting up a Rooster Bank account for any child is simply a matter of downloading the app from Apple or the Google Play Store. Once the app has been downloaded, just follow all the on screen prompts and your child will soon take his/her first steps towards financial independence.

Of course it’s possible to save money at home similar to the way Rooster Money operates their system. Piggybanks, jars and tins are useful for saving coins or notes, while setting up spreadsheets or graphs detailing goals is always a possibility.

There’s no need to bother going to the trouble with Rooster Money. However, this interactive financial service for kids is a great resource, allowing your children to learn how to handle their pocket money and birthday or Christmas cash gifts responsibly.

The benefits of not physically handing cash over until required will please, for any parent and kids will find their savings goals a challenge they will want to meet.

Interactive games and the possibility of joining the Rooster Money community make the site as much fun as possible, while teaching all the rewards that come with adopting a prudent financial attitude.