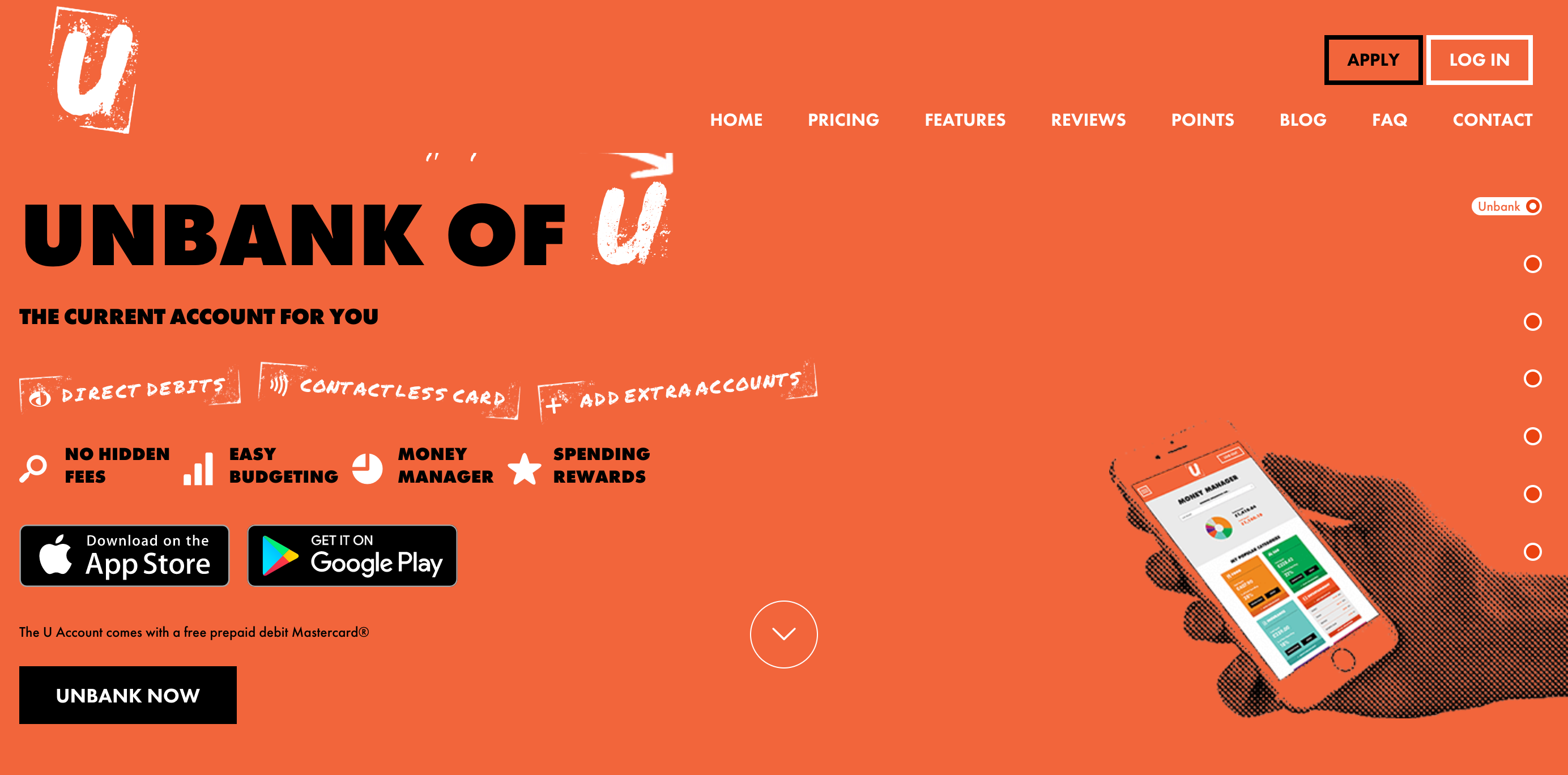

Most of what we have written about on the site has been about pre paid debit cards. However there are people out there that are over 18 and most of the debit cards we have reviewed on this site, they aren’t eligible to apply for. Enter uAccount, in this uAccount review we will put it to the test and see if it’s all that.

One of the primary reasons that people need a basic bank account is down to have bad credit. This used to be less of a problem than it used to the way technology has made basic bank accounts a lot more accessible.

The smartphone and tablet revolution has really helped this industry take off as there was a reluctance from the big banks to offer these kind of services, as they struggle to make money from them.

We’ve already seen how smartphones and debit cards can help teenagers manage their finances, so it’s interesting to see if the same technology can transform this area of the finance industry.

How To Get Started

It’s fairly easy to sign up, just hard over to the uAccount website and fill in a few details. It takes about five minutes to complete and within a fewof days, you will receive your contactless card in the post.

A couple of features to call out:

- You won’t be credit checked

- You can apply if you have bad credit

- The card is FREE

- The banking app (Money Manager) is FREE

What Are The Charges?

So whilst it is free to get started as with most things these days, there will be some charges for using the account. This can be done either in a Pay As You Go way or as a monthly fee.

Pay As You Go

If you elect for the pay as you go way you will be charged for using certain features of the card. They are as follows:

- ATM Withdrawal Within The UK – £1 Per Transaction

- ATM Withdrawal Outside Of The UK – £1 Plus 3% Fee

- Dormancy fee – if the service isn’t used for 60 days then there is a £1 per month charge

- Any standing orders or direct debit, incur a charge of £1 per transaction

- Extra Accounts Cost £1 Per Month

£5 Per Month

If you decide to go for the £5 pay monthly option the charges are as follows:

- £5 Per Month Administration Fee

- ATM Withdrawal Within The UK – 50p Per Transaction

- ATM Withdrawal Outside Of The UK – 50p Plus 3% Fee

- 2 Extra Accounts Are Available Free Of Charge

- Any standing orders or direct debit, incur a charge of 50p per transaction

£10 Per Month

If you decide to go for the £10 pay monthly option the charges are as follows:

- £10 Per Month Per Month Administration Fee

- ATM Withdrawal Within The UK Are Free

- ATM Withdrawal Outside Of The UK – 3% Fee

- 5 Extra Accounts Are Available Free Of Charge

- Any standing orders or direct debit, don’t incur a charge

Once the account is open, it can be used like and other bank account, so things like paying your salary, pension or benefits into the account are possible.