I have been a user of Go Henry for a few years now, when I say me, I mean mainly my kids have used the service. The concept of the product is quite straightforward. You register on their website, they send you a debit card in the post, you load money onto the card via the app or website and your child uses the card to buy the things they need.

Go Henry – GET 2 MONTHS FREE PLUS £5 POCKET MONEY

GET 2 MONTHS FREE PLUS £5 POCKET MONEY

Pocket money has come a long way since I used to count the coppers each Saturday when I went to my Grandmas house. As I have been using the service for a number of years I thought I would create a simple website, to help share my experiences.

Hopefully, you enjoy my Go Henry Review but if you feel like I have missed something out, then please feel free to comment below and I will add it to the review.

Basic Information

It’s an amazing tool that has helped us to educate our children about money, and how to be responsible with it. So much so that we thought we would put together a blog to help other parents and to share our experiences.

It’s a smartphone app, website and contactless VISA debit card, that helps parents teach their children and teenagers how to manage their finances.

The cheque is now virtually unused and buying things with cash is on the decline. I wonder if our children will be the first generation to use electronic money systems, more than cash? The difficulty is that spending on plastic and microchips can easily lead to unmanageable amounts of debt.

This is where the debit card has really helped us as a family and why I wanted to write several Go Henry Reviews, as I believe they are helping to provide financial education to our children, in a fun and practical way.

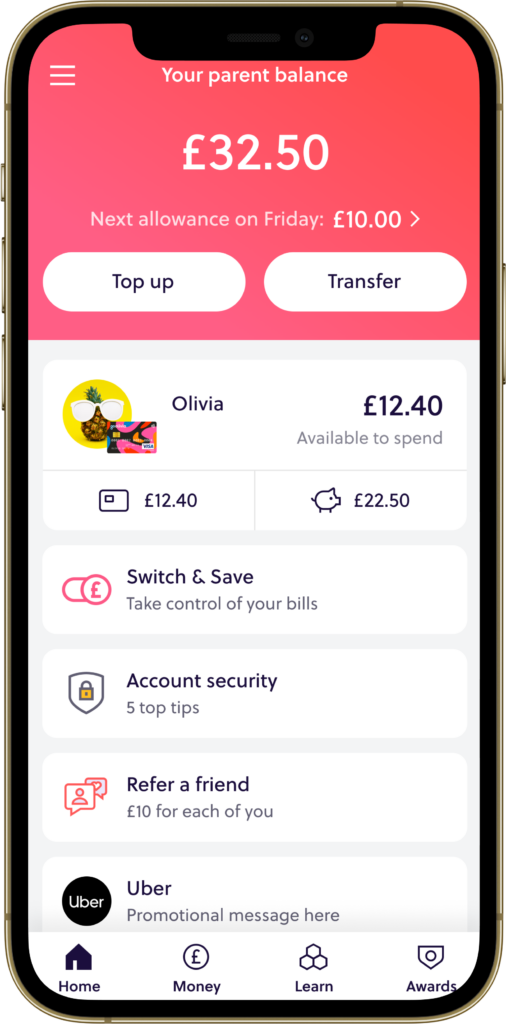

As a parent of two children aged 10 and 12, I feel I have a responsibility to prepare them to manage their finances. GoHenry has a website with full reporting and a simple user interface for setting up the parameters for each child.

I can easily set up controls and allowances and they can only spend what I permit them to spend. They can also earn extra pocket money, I simply add it to their account using my smartphone, at the click of a button.

If your child or teenager has a smartphone, tablet or iPod, then they can also access the smartphone app. The app contains a list of tasks or household jobs that they can perform to earn extra money.

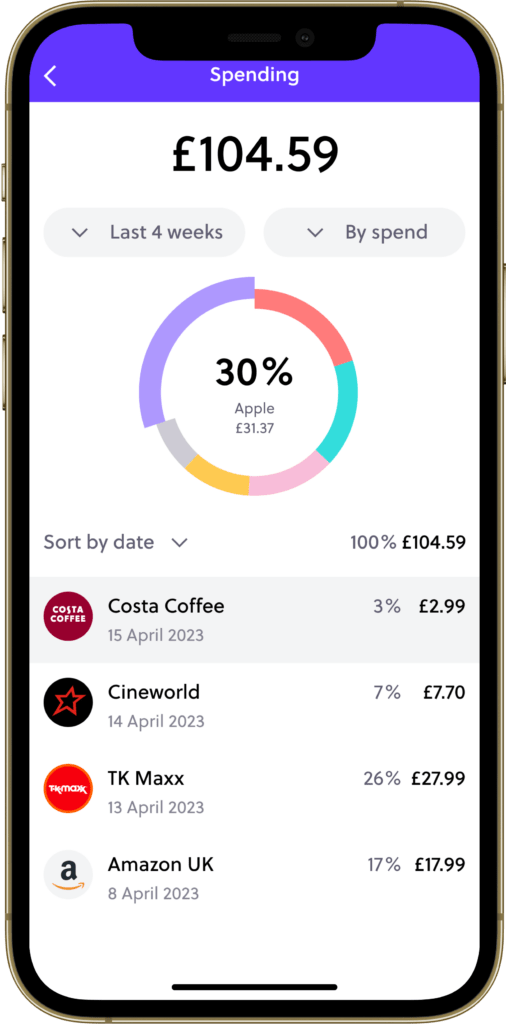

The app also shows them instantly where they have spent their money and what they have left to spend.

How Much Does It Cost?

The great thing is that it’s free for two months. If you sign up through our website. Then it’s just £3.99 per month thereafter. You can also use the promo code to claim the offer when signing up.

There are no other charges for using the card within the UK, free to transfer funds via the bank. To top up the card via a debit card incurs a 50p charge but the funds are available instantly.

Summary Of Charges

Nobody likes signing up to something and then finding out there are hidden costs and fees. After all, we are dealing with a product here for handling your child or teenagers money.

Here is a summary of all the charges:

- Initial Card Is Free

- First 2 Months Free

- £3.99 After 2 Months

- £2 For Using A Cash Machine Abroad

- 2.75% International Usage Fee

- 50p To Load From A Debit Card

Other than the charges listed above everything else is covered in the monthly fee that they charge.

Hidden Charges

There is no overdraft facility with the card and therefore no overdraft fees. We have tested the cards and when you make a purchase your child or teenagers account instantly updates.

You can be confident that when your child or teenager uses the card, they cannot spend use it elsewhere if there are insufficient funds in their account.

All the charges below are fully published on their website so whilst they are not hidden, they can lead to additional charges over and above the £2.49 per month.

Pocket Money Apps

There are other pocket money apps that do a similar job, so it’s only fair when creating this site and writing all the reviews that I also take a look at other similar products.

I have found it to be the most feature rich, but there are cheaper alternatives if you don’t require all of the features.

Other Equivalent Services

There are other products that are similar that you can try, I have also written about Pockit and Osper on my blog but here are some equivalents:

App Download

The Go Henry App is probably the easiest way to manage your account and what your child can and can’t use the card for. From the app, you can set savings goals for your child and see the balance in their account. The card can also be blocked within the app as well as whether or not the card can be used online, at a cash machine, or in shops.

The makers of the product also send you an alert whenever your child or teenager makes an in-store purchase or withdraws money from a cash machine. If they lose their bank card, then at the click of a button, the card can be blocked, either by you or your child/teen.

The following controls can also be put in place:

- Weekly spend limits

- Single Spend Limits

- Cash Machine Limit

- High Street Use

- Cash Machine Use

- Online Use

Available On Google Play

I am an Apple iPhone user but if you are on Android like the Samsung phone then you can get the app from the Google play store and it has all the same features as the Apple iOS version.

I can’t really offer an opinion as to what the Google Play version is like as I have never used the app. If someone has used the Google Play version and would like to write a review for me I am more than happy to publish it on the site.

Grandparents

A grandparent can get a card on behalf of a grandchild. It’s not necessary to be the legal guardian of a child. So long as the person who is applying for the card is over 18 years of age. They have also introduced a relative feature where a parent can send another relative a unique link.

If the relative clicks on the link and registers then they can send a gift and see what tasks your child has been set. This is a great way for the whole family to get involved and encourage their child.

As a security measure, the link is only valid for a set period of time and then it expires.

What To Do With A Lost Card

The good thing about the blocking feature is that if your child is anything like mine they are forever misplacing things. The block can be put in place temporarily via the app and then if the card is genuinely lost, it can be reported and a replacement card sent out.

If the card is genuinely lost then you can call the Lost Card telephone number and get a replacement card sent out. To order a replacement card the number is 0330 100 7676, there is a fee for a replacement card which is £3.99. The same is true if the card is damaged.

It’s an amazing tool that has helped us to educate our children about money, and how to be responsible with it. So much so that we thought we would put together a blog to help other parents and to share our experiences.

My goHenry Card Reviews

Before making my decision to sign up with the card I read numerous reviews but at the time struggled to find one that went into enough detail. This was the main reason for building this website as I wanted to make sure that I shared the benefits of using the card as a parent. Numerous reviews are out there now so it’s less of an issue.

What I have learned over the past three years

Time flies by and when I first started to use the card my eldest son Isaac was 10. Now he is 13 and in the second year of high school.

We load his card with his bus fare and lunch money. He can decide to ride his bike to school instead and take sandwiches and therefore keep the money.

Hopefully, this is helping to teach him to be responsible with his money, if there are ways you can save, then it’s a good thing.

It has worked that well we will probably do the same with our younger son Jonathan.

What My Kids Like – Card Designs

An addition that they added quite recently was the ability to customise the card. The original card design was a little boring, so the fact that the card can now be customised adds a little bit of personality.

A new card design can be ordered through the app should you wish to update your existing card. There is a one off cost of £4.99 for the new card but there are some amazing designs to choose from. Your child can easily inject their personality into their card, making it a lot more fun.

There are animal designs to choose from, this includes a pug, kitten, monkey, hamster, horse, emu to name just a few. Should your child be more sports orientated they can choose a basketball or football design.

There are also funky patterns if your child has a creative personality or just the ability to have a plain card in their favourite colour.

It’s a welcomed addition and it’s nice to see the company making their product more appealing.

Money Missions

GoHenry recently launched money matters as a way for kids to learn lots of financial lessons. the features are so good I decided to create a dedicated page to go into all the information about how this works so you can find out all about Money Missions.

The basics are that your child earns points for completing a series of tasks from how to save and budget to learn how to invest or how taxes work!

How Does Go Henry Work Work?

How does it work? You may ask. Quite easily. There is a smartphone app, a website, parental controls and a contactless debit card. You simply load funds into your child’s app and they are free to use the card however they want, so long as it works to comply with the parental rules that you put in place.

Is It A Bank Account?

When you start a blog about a subject you tend to get asked a few questions about the product. I am more than happy to help where I can so please feel free to email me.

I have been asked several times is it a bank account? Although not technically a bank account, it is pretty much like a bank account because it offers all the same functionality and when it comes to children’s banking, they actually offer more. This is why when you do a search for goHenry bank account reviews you will see lots of comparisons between the two.

One thing that is worth mentioning, though, is that your money deposited isn’t covered by the FSA Compensation Scheme.

This is a government backed scheme, whereby up to £85,000 of your money is covered, should something happen to the bank or building society.

As the makers of the product aren’t a bank they deposit all your money into a NatWest account. This is covered by the FSA, so should NatWest go bump the money is covered. Should the creators go bump under the terms of being a VISA operator, it means that your money is protected by NatWest bank and they would return the funds.

So from a security point of view, it’s as secure as any other financial product on the market.

Other Options

There are other options that we have tried out and tested which we have also included in the blog. Hopefully or Go Henry or Osper blog post will be of some use to you.

To summarise Osper always seems to be catching up to but they are gaining ground quickly and it’s a reasonable alternative.

Card Charges & Cost

In addition to the monthly fee, there are a number of additional charges for using the account. I have summarised these into a table for you. They are very similar to the charges that your bank would issue.

Overall I don’t think that the additional charges are unreasonable and are mainly there because of the fees banks charge for international transactions.

The only fee that will affect you if you are based in the UK is the Debit Card loading fee which is currently 50p. This can easily be avoided by topping up your account by bank transfer.

If you think that the prices that Go Henry charges, we have listed some other options for you to look at.

These are as follows, Osper, Pockit and Nimbl.

Referral & Refer A Friend Scheme

If you sign up via our website we have an amazing offer of two months for free. If you sign up via their website they offer you a month for free, so it’s worth getting the additional month for free as this will give you the chance to try it out properly before deciding whether or not it’s for you.

To get started simply click the link below:

It doesn’t cost anything to get started and you can always cancel should you decide it isn’t for you.

Parent Account Login

It has a parent account login for the app. This enables you, as the parent, to log in and configure the different options. As a parent, you can set the spending limits on each child’s account and configure where the card can be used.

Daily Tasks

As the parent, you can also create daily tasks that your child can complete to earn more pocket money.

Conclusion

There are cheaper alternative products on the market if you’d like to read more about these then take a look at Osper, Pockit or Nimbl.

The biggest thing I have discovered when taking a look at the competing products is that they either lack the features of Go Henry or they contain charges for things like withdrawing money from a cash machine.

These hidden charges aren’t ideal really and could lead to your child losing a large proportion of their spending money in fees. For this reason, I give Go Henry a 5 star marking and give it a thumbs up. You can trial it for 2 months for free, this gives you the opportunity to explore the product and see if it’s the right fit for your fami

Pocket money has come a long way since I used to count the coppers each Saturday when I went to my Grandmas house. As I have been using the service for a number of years I thought I would create a simple website, to help share my experiences.

Hopefully, you enjoy my Go Henry Review but if you feel like I have missed something out, then please feel free to comment below and I will add it to the review.

DISCLAIMER – THIS IS AN INDEPENDENT WEBSITE WITH NO OFFICIAL CONNECTION WITH THE CREATORS OF GO HENRY