Go Henry isn’t the only option when it comes to helping to teach your child or children about managing their pocket money. We take a look at other Go Henry alternatives to see how they stack up. Osper is the first alternative that we look it.

The get started with Osper you just register via their website. Head over to osper.com/order to fill in a form and get started. The first thing that I liked about Osper was the speed at which they sent out their debit card. Within a couple of days of filling in their online form we got the following in the post:

Go Henry took about a week for the card to arrive in the post. We did sign up over the Christmas period so it’s hard to say if Go Henry would normally take this long. It’s very impressive that Osper could get their card shipped out so quickly even over the festive period, when the post is notoriously slow. So a big thumbs up to them for managing to achieve that. Such an impressive start fills you with confidence about the quality of the product.

To sign up with Osper you fill in a quick form on their website with your name, address, date of birth, gender and the name you would like printing on the first card. As the card holder will be one of your children then this should be their name.

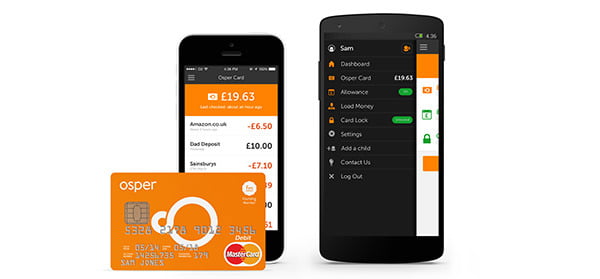

Once the card arrives in the post, as shown in the image above I visited osper.com/go to register the card. I created an adult user account and also an account for the child that will be using the account.

As part of the account creation process I had to enter my mobile phone number and email address. Both my email address and mobile phone required confirmation before my account could be used. The confirmation process is straight forward. I had to click a link that had been sent to my mobile phone and the same process with my email address. I also created myself a username and password to administer the account going forward.

Once everything was confirmed I then had to create a user account for my child so that they could use the card. It’s optional to enter your child’s mobile number and email address. However, if you do this they require activating in the same way that the parents address needs activating. The child account also needs a username and password. In the end you end up with the following:

- A child username and password. One is required per Osper card. Optional email and mobile number but these need to be activated if they are specified. They have to be unique and cannot be the same as the parents. If none is specified all notifications etc are sent to the parent account.

- A parent username and password. Email registration and activation is required.

- The child account is used to view the balance, block the card if it is stolen and review the spending on the account. The parent account has all the features of the child’s account plus the ability to top up the account and allocate funds to the child’s Osper account.

The Osper App

The app works on Apple and Google Android. Once I had downloaded the app to my iPad Mini 2 and fired it up the app just hung there with a bright orange background displaying the Osper logo.

Maybe I am a little impatient but I am a big fan of technology that just works first time so I found this a little frustrating. I quit the Osper App a couple of times and restarted it to try and get it going. However, it just wouldn’t work. I tried it on my smartphone and the Osper App started up just fine. I am guessing there are issues with the Osper App on an iPad Mini 2. I also tried the Osper App on a friends iPad 3 and it worked fine.

When I fired up the app I can either login as a parent or child. Depending on which account I use, I get different options. Parents can load money onto cards, setup a regular allowance, permit the account to be used online, block the card, see the current balance and where the card has been used.

Child accounts can do all of the above except setup a regular allowance or load money onto the card. In addition, the child account can request a PIN reminder. The PIN reminder either gets sent to a child’s mobile number, if their mobile number is registered with the account. If the mobile number is not registered with the account then the PIN reminder goes to the parents mobile number.

It’s worth noting that since writing the review there has been an update to the app and it now works with my iPad mini 2. I have left the comment in for completeness.

Osper – Website

Other than ordering your card through the website and activating the card, you don’t have the ability to do anything else with regards managing the card. Personally I like to have the ability to use a computer as well as a tablet or smartphone, I hope that Osper will address this in the future and give parents the ability to manage their account using the website.

Osper – loading funds into your account

This needs to be done through the app. You login as a parent and then from the app funds can be loaded onto the child’s debit card. In order to do this the parent needs to have their debit card registered. Registering a debit card is done via the Osper app. The first six loads in a month are free, additional loads are 25p per transaction.

From the parent account, it is also possible to request that money is loaded onto the card via another source. The child account also has this facility. The idea behind this is someone other than the parent can top up the account. For example, a grandparent can load birthday money onto the card as a present. Whilst this is a great idea in principle this poses problems because of the way the fair usage policy works. This is something I will get onto in a moment but after 6 loads there is a fee of 25p per transaction. Six family members send a gift and now it starts to cost the parent money. I am not sure if this has been thought through.

Osper – Fair Usage Policy

I will say this about fair usage policies, I hate them. I hate them so much I will say it again – I hate them! They are a marketing tool used to suck people in with headline prices that look attractive, so that the true cost of owning something can be hidden. People can argue that the full terms and conditions are on their website and that it clearly explains it. However, they are normally hidden away somewhere, behind all the big bright flashiness of how cheap something is.

I do agree that light users of a product do benefit from fair usage policies as they tend to pay less. However, we are talking about a financial product here aimed at children and teenagers. It adds unnecessary complexity and I am trying to teach my children about handling money, not handling money and making sure they don’t fall foul of a fair usage policy.

I have enclosed a copy of their charges for you. These are correct as of January 2015, this is copied directly from the PDF on their website:

Osper operates a Fair Use policy. This is to ensure the overall cost of Osper remains affordable for all our subscribers. Once people have exceeded the fair use policy, we reserve the right to charge.

Fair Use calculated on a monthly basis is defined as follows:

Withdrawals: Up to 6 ATM withdrawals per month per Osper Card (£0.25 fee for each additional withdrawal)

Balance Checks at ATM Machines: Up to 3 balance checks per ATM machine per month per Osper Card (£0.25 fee for each additional ATM balance check)

Loading Money: Up to 6 loads from parents / guardians per month per Osper Card (£0.25 fee for each additional load)

Go Henry Alternatives – Conclusions

Osper is the closest alternative to Go Henry, the smartphone app is well put together and easy to use. Signing up and getting the card through the post was very quick. Loading money onto the card, PIN reminders and creating child accounts are all very straight forward. They need to look at the fees and charge a higher upfront or annual fee so that they can abolish the fair usage policy.The website needs to have the same management features as the smartphone app and more parental controls need to be put into place.

Leave a Comment