Student debt is at an alarming high. Statistics have shown that in 2017 currently in the UK the average amount of debt for each of the graduates is £32,220. Some of the UKs graduates will be in a lifetime of debt, as they will never earn enough to pay it off.

The biggest source of the debt comes from the tuition fees and the interest that gets charged on the loans. Some the tuition fees are as high as £9000 a year. Factor in the interest charged on these loans and you will quickly seen how the amount quickly adds up.

Originally the idea was that the debt doesn’t have to be repaid until you start earning a set amount. Also the debt would be written off by the time you reach the age of 30.

In the end students have to now settle that this is no longer the case and so therefore they are left to repay the whole debt, some will be for the rest of their lives.Many student suffer even more when after starting their course, they decide to make a switch, this affects both the fees and their living expenses.

For some students they don’t get a job immediately so they don’t have to start repaying and sometimes they do get a job but they have to wait a while before they start paying back the loan, so therefore while they are not able to do so, their interest is rising.

Because of this many have decided not to attend because they are able to see from their family members and friends what they are going through with repaying these loans.

Just to more insult to injury that Universities are continuously raising the prices of their fees.Anxiety of not being able to pay these tuition fees are affecting students and causing many not to place their real focus on learning. The students are actually pleading to the government to reconsider the fees but it seems to no avail. You would think that the Government would be doing all they can to see what they can do to eliminate these issues however studies show that the government believes that this is the correct thing to be doing!

Does the government know there is also a future generation that is coming from this same generation who will be tied up in debt forever?When we look at these issues then we all can agree that grants are way better than these student loans that were said to be in place to help but is rather causing more bad than good. Now, one also has to blame the students that cause more debt on themselves that what could be avoided.

Like the ones who have to change courses because they recognise in the middle of the course that this was something that they didn’t want to do or they do not like it.

Before starting the course do your research before you actually go ahead and start the course. For the Parents who just listen to what their children say they want to do and not go through the necessary steps to ensure that this was the right course for them.

Knowing that the fees are so high you also have to learn to budget to ensure that you are able to make the payments and its always wise to save ahead, so there are financial companies that gives you the opportunity to save for the child, until he or she is a certain age then the money will become accessible to them.

In getting this money which you have saved, an interest is accumulated on it over a period of time so therefore you have something starting off with.

The amount saved should even cover a whole year or two of their university education. Another piece of advice for student is to apply for Student Aid and get a job to help finance these tuitions fees. Working and studying can be hard but once time is managed properly then it will work for the greater good. Get as many scholarships as you can. Remember that you will never have to pay a scholarship back. There are hundreds available to you from different sources and utilise them as best as possible.

The more you are awarded the less you’ll have to pay in student loan and even if they are small, every little bit counts.Become an intern. Many internships are voluntary but you also have those that comes with a salary. Now while you are doing this, you are not just earning an income but you are also building up experience. By gaining experience you will give yourself a better chance of getting a job once you graduate.Avoid getting a credit card as much as possible. Credit card companies tend to target University students because of course they believe you can easily pay your tuition and pay them back. Remember, if you are not on time with these payment, you are only tying yourselves more in debt more than you could ever imagine.

Always write down your expenses because budgeting is very essential and being able to pay bills on time. Being organised is always the way to go and one will find that it makes life so easy. Write down every bill, money spent and all you have spent daily, weekly and monthly. Expenses paid on food, clothes and hanging out. When everything is visible then you can be aware of the extra you have to spend.Its recommended that you buy your own food. Avoid going out for dining, buy your own groceries and prepare your own meals. Not only is this healthier but it cost way less.Get your text books used.

Books are a very huge part of university expenses whether you believe it or not. There are a wide variety of places that you can purchase used text book from, one of those places are online on amazon.co.uk or ebay.

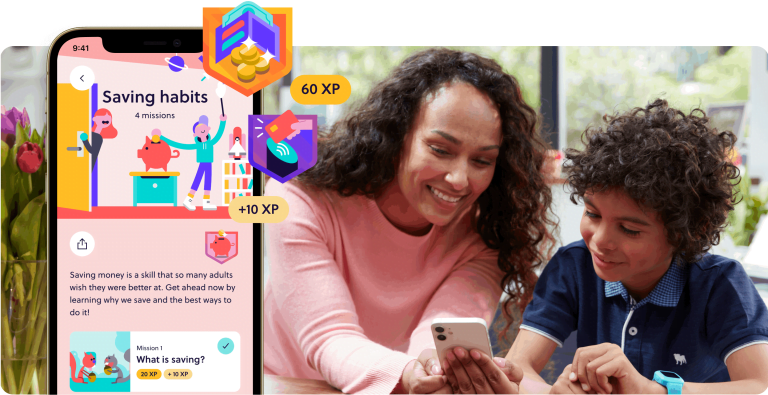

Most book stores have a used section where textbooks can cost way less than the original price. Because they are used, automatically the prices have to be reduced. Make good use of this as much as you can.Another great and probably one of the most important advise is for parents to start early when it comes to helping your child learn how to budget. If you read our Go Henry Review blog post, you can find out about a debit card and smartphone app that can help you to build financial confidence with your child.

Being better with money, can only help you child when they start their University course.