There are many different methods you can use when it comes to teaching children about money. Offline or online, cash or electronic, financial education isn’t on the school curriculum. Maths certainly is on the curriculum but managing money and all the emotions that come with it is far more complex than 20p plus 10p equals 30p.

10% CASHBACK ON PURCHASES

×Proofread ×Proofread

99p to signup and earn 10% cashback on purchases

×Proofread SIGN UP TO POCKITlorem ipsum dolor

I have put together some tips and tricks that you will hopefully find useful when it comes to teaching children about money.

Tip 1

“It’s your responsibility as a parent or guardian to do it”

My first tip when it comes to teaching children about money is this – no one else is going to do it for us. I know for years that Martin Lewis from moneysavingexpert.com has said that it should be taught as part of the national curriculum. I agree with him, because the reality is that not all parents will make this a priority. There could be numerous issues why they won’t; lack of time, lack of motivation to do it or not recognising how important it is that our kids handle money correctly. Maybe some parents or guardians have yet to learn the necessary skills for themselves so are unable to teach their kids.

The other big reason could be that if as a parent or guardian you are struggling with debt, it could seem hypocritical to try teaching children about money. The opposite can also be true. When someone gets something so wrong, it gives them extra motivation to make sure that the mistakes aren’t repeated.

When it comes to teaching children about money I really struggled at first. As a child growing up there wasn’t enough money to go round. Most of the time, the priority was deciding who is going to get paid this week and who is going to have to wait until next week. It was hand to mouth, as they say. In my childhood home, teaching children about money was not top of the agenda. Maybe if they did have a ‘Teaching Children About Money’ class at school I wouldn’t have got into so much debt when I got my first job.

The people I look to as being financially savvy all seem to have one thing in common; they were taught at a very young age by their parents to take responsibility for their money and they were given or earned some money that was their’s to spend as they pleased. If they made bad choices, it wasn’t the end of the world because it was such a small amount. They were young enough and the amount was small enough to learn and move on.

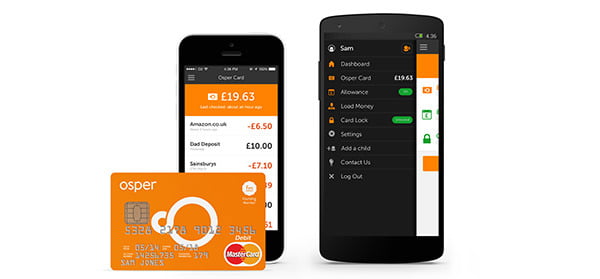

OSPER – £3 POCKET MONEY

& 1 MONTH FREE

×Proofread

Sign up to Osper and you will get £3 FREE pocket money and 3 months FREE

×Proofread 1Sign Up Now!lorem ipsum dolor

Tip 2

“Start with the basics”

The classic book David Copperfield by Charles Dickens has a character called Wilkins Micawber. Wilkins Micawber is sent to debtors prison for failing to pay his creditors. There is a famous quote from the book:

“Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.”

A modern slant would be annual income £20 with annual expenses of £19.99 equals happiness. Annual income of £20.00 with annual expenses of £20.01 equals misery. Yes, that poses the question of savings, but tip 2 of teaching children about money is to start with the basics. If you spend more than you earn, then it leads to trouble. As parents, we need to be disciplined in teaching our children to do without material possessions every now and again. If they don’t have enough money to buy something then they can do without it. It’s not going to do them any harm.

Set up a system by which your children have a regular amount of money that they can choose to spend however they want. It’s up to you to set up the amount. Agree how often they get the money, how they can potentially earn extra money and then stick to your guns.

It’s certainly helped us bring a little more harmony into the family home. The kids even want to load the dishwasher!

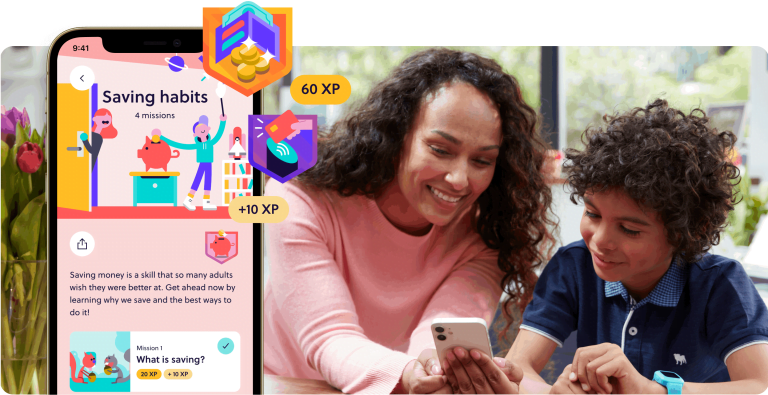

GO HENRY SIGN UP2 MONTHS FREE

×Proofread ×Proofread

Go Henry has an amazing offer, sign up to Go Henry through our website and you will get2 MONTHS FREE

×Proofread SIGN UP TO GO HENRYlorem ipsum dolor

Tip 3

“Don’t lend your children money if they can’t pay it back”

We live in a world where it’s far easier to get cheap credit than ever before. Remember the lesson from Wilkins Micawber about misery and happiness. Spending more than you earn = misery.

What’s the difference between a bank and a parent? The bank wants their money back, but I know a lot of parents who let their children off by letting them not pay back their debts. It’s probably healthy to once in a while loan your children some money, but make sure they pay it back in full from their agreed allowance.

I recently lent my eldest child Isaac some money so he could buy some Lego. He also borrowed some money from his younger brother Jonathan shortly afterwards. It took him five weeks to pay the pair of us back. He wasn’t bothered for the first two weeks but by weeks three, four and five he was fed up.

I am not sure if going into debt once is enough for him to learn his lesson but he didn’t enjoy the experience. You are not doing your child any favours by letting them off the hook when it comes to debt. I am not necessarily anti-debt, managing debt is part of life and when your child is ready, teaching them about debt repayments is a good thing.

Teaching them they can borrow money and not pay it back is counter productive. Teaching them, it’s ok to spend more than they have and someone will foot the bill is a very dangerous habit for a child to get into.

No one said being a parent was easy, sometimes we have to be cruel to be kind.

OSPER – £3 POCKET MONEY

& 3 MONTHS FREE

×Proofread

Sign up to Osper and you will get £3 FREE pocket money and 3 months FREE

×Proofread 1Sign Up Now!lorem ipsum dolor

Tip 4

“Talk about money”

I make the habit of speaking with my two boys a few days after the purchase. Especially if I feel like they have wasted the money to find out how they feel about it post purchase.

Leave a Comment